(a) Delay in equalisation of OROP w.e.f July 2019.

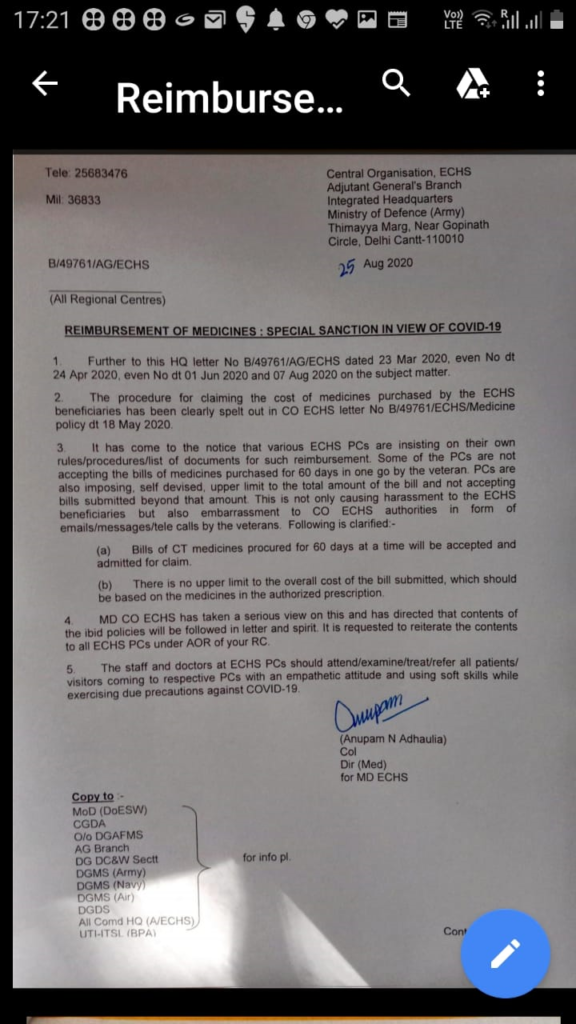

(b) Non availability of medicines in ECHS polyclinic.

(c) Anomalies in pension PBOR.

(d) Withdrawal of Income Tax exemptions on disabled Veterans.

(e) Release of OMJC Report at the earliest.

(f) Disbursement of pension by PCDA(Pen) in place of Banks i.e CPPC.

(g) Constitution of Veterans Commission.

Veterans were assured that progress on these points would be

given after action by them in due course of time and meeting with

CGDA as requested by President, IESL regarding points at

Para 1(a) and (f) mentioned above will be arranged shortly.

with regards

Brig Kartar Singh (Retd)President IESL

Inform wards of Battle Casualties to apply for direct SSB interview on www.joinindianarmy.nic.in before 5 Feb 2020.

Eligibility.

Final year graduation or graduation completed with minimum 50% and age between 01 July 2001 to 02 July 1995.

How to apply and documents required are given in notification.

Battle casualty includes :

1. Provision should be made in the budget to allocate funds to cater for revision and equalisation of One Rank One Pension and the arrears which have been due to the Ex-Servicemen since 01 July 2019.

2. The High Risk & Counter Insurgency allowance, the High Altitude allowance and the Siachen allowance admissible to the Armed Forces personnel should be exempted from Income Tax.

3. The Central Police & Para Military Forces (CPMF) are getting more Risk and Hardship Allowance as compared to the Armed Forces. The same should be brought at Par with the CPMF.